What is Forex (FX)?

Forex (FX) is the marketplace where various national currencies are traded. The forex market is the largest, most liquid market in the world, with trillions of dollarschanging hands every day. There is no centralized location, rather the forex market is an electronic network of banks, brokers, institutions, and individual traders (mostly trading through brokers or banks).

Many entities, from financial institutions to individual investors, have currency needs, and may also speculate on the direction of a particular pair of currencies movement. They post their orders to buy and sell currencies on the network so they can interact with other currency orders from other parties.

The forex market is open 24 hours a day, five days a week, except for holidays. Currencies may still trade on a holiday if at least the country/global market is open for business.

Forex Pairs and Quotes

When trading currencies, they are listed in pairs, such as USD/CAD, EUR/USD, or USD/JPY. These represent the U.S. dollar (USD) versus the Canadian dollar (CAD), the Euro (EUR) versus the USD and the USD versus the Japanese Yen (JPY).

There will also be a price associated with each pair, such as 1.2569. If this price was associated with the USD/CAD pair it means that it costs 1.2569 CAD to buy one USD. If the price increases to 1.3336, then it now costs 1.3336 CAD to buy one USD. The USD has increased in value (CAD decrease) because it now costs more CAD to buy one USD.

Forex Lots

In the forex market currencies trade in lots, called micro, mini, and standard lots. A micro lot is 1000 worth of a given currency, a mini lot is 10,000, and a standard lot is 100,000. This is different than when you go to a bank and want $450 exchanged for your trip. When trading in the electronic forex market, trades take place in set blocks of currency, but you can trade as many blocks as you like. For example, you can trade seven micro lots (7,000) or three mini lots (30,000) or 75 standard lots (750,000), for example.

How Large Is the Forex?

The forex market is unique for several reasons, mainly because of its size. Trading volume is generally very large. As an example, trading in foreign exchange markets averaged $5.1 trillion per day in April 2016, according to the Bank for International Settlements.

The largest foreign exchange markets are located in major global financial centers like London, New York, Singapore, Tokyo, Frankfurt, Hong Kong, and Sydney.

How to Trade in the Forex

The forex market is open 24 hours a day, five days a week across major financial centers across the globe. This means that you can buy or sell currencies at any time during the week.

From a historical standpoint, foreign exchange trading was largely limited to governments, large companies, and hedge funds. But in today's world, trading currencies is as easy as a click of a mouse. Accessibility is not an issue, which means anyone can do it. Many investment firms, banks, and retail forex brokers offer the chance for individuals to open accounts and to trade currencies.

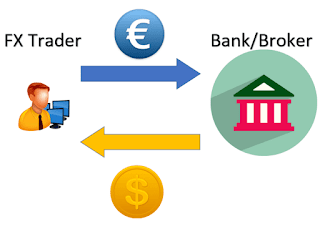

When trading in the forex market, you're buying or selling the currency of a particular country, relative to another currency. But there's no physical exchange of money from one party to another. That's what happens at a foreign exchange kiosk—think of a tourist visiting Times Square in New York City from Japan. He may be converting his physical yen to actual U.S. dollar cash (and may be charged a commission fee to do so) so he can spend his money while he's traveling. But in the world of electronic markets, traders are usually taking a position in a specific currency, with the hope that there will be some upward movement and strength in the currency they're buying (or weakness if they're selling) so they can make a profit.

A currency is always traded relative to another currency. If you sell a currency, you are buying another, and if you buy a currency you are selling another. In the electronic trading world, a profit is made on the difference between your transaction prices.

Spot Transactions

A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. The major exception is the purchase or sale of USD/CAD, which is settled in one business day. The business day calculation excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. During the Christmas and Easter season, some spot trades can take as long as six days to settle. Funds are exchanged on the settlement date, not the transaction date.

The U.S. dollar is the most actively traded currency. The euro is the most actively traded counter currency, followed by the Japanese yen, British pound and Swiss franc.

Market moves are driven by a combination of speculation, economic strength and growth, and interest rate differentials.

Forex (FX) Rollover

Retail traders don't typically want to take delivery of the currencies they buy. They are only interested in profiting on the difference between their transaction prices. Because of this, most retail brokers will automatically "rollover" currency positions at 5 p.m. EST each day.

The broker basically resets the positions and provides either a credit or debit for the interest rate differential between the two currencies in the pairs being held. The trade carries on and the trader doesn't need to deliver or settle the transaction. When the trade is closed the trader realizes their profit or loss based on their original transaction price and the price they closed the trade at. The rollover credits or debits could either add to this gain or detract from it.

Since the fx market is closed on Saturday and Sunday, the interest rate credit or debit from these days is applied on Wednesday. Therefore, holding a position at 5 p.m. on Wednesday will result in being credited or debited triple the usual amount.

Forex Forward Transactions

Any forex transaction that settles for a date later than spot is considered a "forward." The price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. The amount of adjustment is called "forward points." The forward points reflect only the interest rate differential between two markets. They are not a forecast of how the spot market will trade at a date in the future.

A forward is a tailor-made contract: it can be for any amount of money and can settle on any date that's not a weekend or holiday. As in a spot transaction, funds are exchanged on the settlement date.

Forex (FX) Futures

A forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date, called the expiry, in the future. Futures contracts are traded on an exchange for set values of currency and with set expiry dates. Unlike a forward, the terms of a futures contract are non-negotiable. A profit is made on the difference between the prices the contract was bought and sold at. Most speculators don't hold futures contracts until expiration, as that would require they deliver/settle the currency the contract represents. Instead, speculators buy and sell the contracts prior to expiration, realizing their profits or losses on their transactions.

Forex Market Differences

There are some major differences between the forex and other markets.

Fewer Rules

This means investors aren't held to as strict standards or regulations as those in the stock, futures or options markets. There are no clearing houses and no central bodies that oversee the entire forex market. You can short-sell at any time because in forex you aren't ever actually shorting; if you sell one currency you are buying another.

Fees and Commissions

Since the market is unregulated, how brokers charge fees and commissions will vary. Most forex brokers make money by marking up the spread on currency pairs. Others make money by charging a commission, which fluctuates based on the amount of currency traded. Some brokers use both these approaches.

Full Access

There's no cut-off as to when you can and cannot trade. Because the market is open 24 hours a day, you can trade at any time of day. The exception is weekends, or when no global financial center is open due to a holiday.

Leverage

The forex market allows for leverage up to 50:1 in the U.S. and even higher in some parts of the world. That means a trader can open an account for $1,000 and buy or sell as much as $50,000 in currency, for example. Leverage is a double-edged sword; it magnifies both profits and losses.

Example of a Forex Transaction

Assume a trader believes that the EUR will appreciate against the USD. Another way of thinking of it is that the USD will fall relative to the EUR.

They buy the EUR/USD at 1.2500 and purchase $5,000 worth of currency. Later that day the price has increased to 1.2550. The trader is up $25 (5000 * 0.0050). If the price dropped to 1.2430, the trader would be losing $35 (5000 * 0.0070).

Currency prices are constantly moving, so the trader may decide to hold the position overnight. The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U.S. If the Eurozone has an interest rate of 4% and the U.S. has an interest rate of 3%, the trader owns the higher interest rate currency because they bought EUR. Therefore, at rollover, the trader should receive a small credit. If the EUR interest rate was lower than the USD rate then the trader would be debited at rollover.

Rollover can affect a trading decision, especially if the trade could be held for the long term. Large differences in interest rates can result in significant credits or debits each day, which can greatly enhance or erode the profits (or increase or reduce losses) of the trade.

Most brokers also provide leverage. Many brokers in the U.S. provide leverage up to 50:1. Let's assume our trader uses 10:1 leverage on this transaction. If using 10:1 leverage the trader is not required to have $5,000 in their account, even though they are trading $5,000 worth of currency. They only need $500. As long as they have $500 and 10:1 leverage they can trade $5,000 worth of currency. If they utilize 20:1 leverage, they only need $250 in their account (because $250 * 20 = $5,000).

Making a profit of $25 quite quickly considering the trader only needs $500 or $250 in the capital (or even less if using more leverage), shows the power of leverage. The flip side is that if this trader only had $250 in their account and the trade went against them they could lose their capital quickly.

It is recommended traders manage their position size and control their risk so that no single trade results in a large loss.

تعليقات: 0

إرسال تعليق